Data to power smarter decisions in insurance

In today’s insurance landscape, the power of data cannot be overstated.

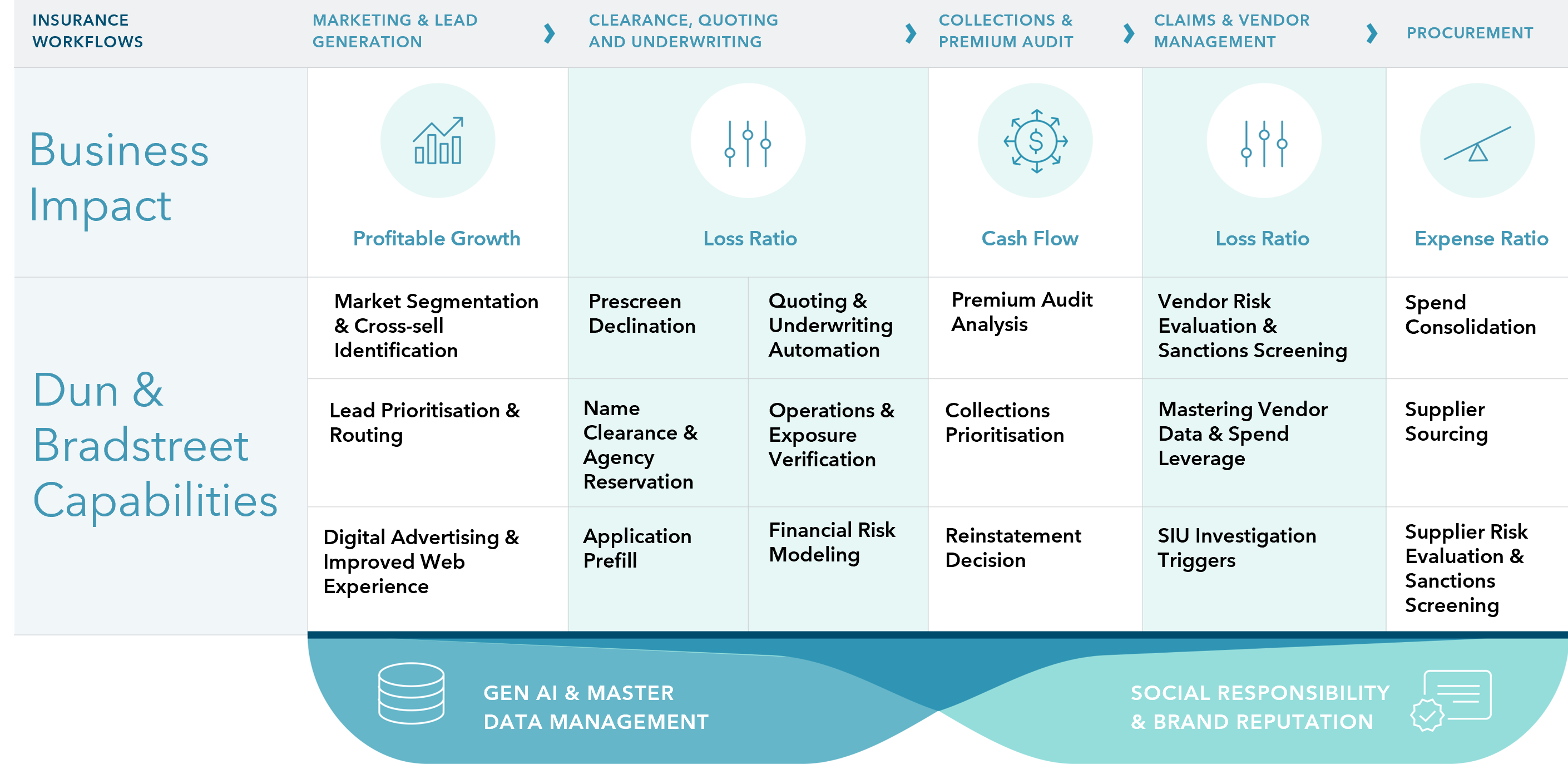

Dun & Bradstreet’s global business data, analytics and local industry expertise assist insurers and brokers to drive innovation across the value chain, including:

enabling master data management strategies throughout the enterprise

supporting the activation of technology investments

enhancing compliance and risk assessments

improving customer experience

understanding ESG insights

making smarter underwriting decisions.

How we help

Discover how Dun & Bradstreet data can help support innovation, enable ESG insights, improve compliance and risk assessments and facilitate faster, more accurate pricing and underwriting decisions.

Supporting your innovation journey

Recent world events have exposed the reliance on legacy operating models used in the insurance industry and embracing digital technology change is a challenge for the sector.

Moving forward, leading insurers will be the ones leveraging digitalisation and AI, with accurate and controlled data at the foundation of their transformation.

Dun & Bradstreet’s vast structured and enhanced global dataset, and deep insurance industry expertise, makes us an ideal partner to support your innovation plans.

Commercial and Specialty Underwriting Solutions

Marine underwriting

Dun & Bradstreet partners with Concirrus, to transform billions of records of cargo movements to actionable, near real-time insights into portfolio risk exposure in the following areas:

- Accumulation of cargo and values onboard each vessel, and in ports and warehouses.

- Ownership, company linkages and counterparties involved in each journey.

Commercial Insurance for SMEs

SMEs are typically underinsured, with around 44% not having business insurance.

D&B’s Unified Risk View (combined consumer + commercial data) improves pricing accuracy through better understanding of an SME’s financial risk, both before underwriting and monitoring during the customer lifecycle.

Who We Help

Dun & Bradstreet works with all of the top 10 global insurance brokers by revenue

Source: Statista

Dun & Bradstreet works with 8 of the top 10 fastest growing Lloyd’s of London syndicates

Source: Society of Lloyds

Dun & Bradstreet works with 17 of the top 20 UK insurers by revenue

Source: Insurance Post

Customer Stories

Generali

Yanna Winter and Hayden Seach

When Generali realised that they needed to become more agile and customer centric, they engaged Dun & Bradstreet to help support their exciting innovation and data strategy.

"Whilst the complexity of data increases, the integrated Dun & Bradstreet Solution across our global applications has allowed our organisation to consolidate our customer data to a single standardised view, giving us a complete view of our customer."

Read moreGenerali

Jenny Linke, Chief Operating Officer, Generali Global Corporate & Commercial

“Our screening solution allows us to have a fully integrated workflow with comprehensive data enrichment, covering everything from sales and underwriting activities to compliance and audit, all without system breaks or email traffic.”

Read moreInternational Medical Insurer

Leveraging real-time data for risk management

This international medical insurance provider offers millions of customers access to high quality global health cover, whenever and wherever they need it. Their key challenge was how to deliver swift, clear and consistent risk decisions in a fast-evolving global landscape. Dun & Bradstreet solutions help them provide customers with insurance protection shaped by essential risk checks and due diligence, and without breaching any local or global regulations. That’s vital to upholding the brand’s great reputation amid increasing complexity of third-party risk monitoring.

Read moreHow data can help insurers make smarter decisions

Data is crucial for making informed insurance decisions.

When evaluating risk, insurers can evaluate data points like predictive analytics regarding business failure and/or financial metrics that review credit, cash flow, ESG credentials can help to inform underwriting and premium decisions. In this case, data ensures fair pricing and helps insurers assess the likelihood of claims.

When looking to better understand customer needs and improve the customer experience, insurers can collect and use data to tailor products and services.

The insurance industry is highly regulated and must comply with laws and rules set by multiple groups. Data can help surface risks which would make them incompliant if they were to insure or be supplied by a particular company.

Up to date data and predictive analytics regarding business failure and/or financial metrics can help to inform pricing and product decisions. By making effective decisions, insurers can improve their ability to compete on price and offerings.

Latest Insurance News & Views